Introduction

Advice of L/C means the notification of the received L/C or its amendments to the beneficiary by United Finance.

Features

The product can help the beneficiary (exporter) under the L/C timely receive the L/C or its amendments verified of their genuineness.

Target Customers

Beneficiary under L/C

Application Qualifications

1. The applicant shall hold a business license of legal person that has passed the annual inspection or other valid certificates which fully prove its legal operation and scope of business;

2. The applicant shall have the qualification to engage in import and export trade.

Process

1. After United Finance receives the foreign L/C or its amendments, it will verify its genuineness by checking the specimen/stamp or test keys;

2. United Finance will notify the beneficiary of the L/C or its amendments, advise the beneficiary of potential risks in the L/C terms.

3. United Finance will use its RMA with HSBC Bank UK to advice.

Letter of Credit Issuance

Introduction

The L/C is a payment undertaking by United Finance to the foreign importer. United Finance will fulfill its payment obligation when the terms stipulated in the L/C are complied with.

Features

1. Improvement of your bargaining position in a negotiation - opening L/C provides the exporter with a conditional payment commitment on top of the commercial credit, giving you better credit by which you may win favorable price terms for your goods;

2. Warranty of your cargo - commercial credit is enhanced by bank credit through the product. The trade itself will be warranted by the bank, and the ownership of the cargo, shipping date and quality of cargos are well controlled under the documents and terms;

3. Reduction of fund occupation - for the importer who uses the L/C with credit limits, the fund occupation will be minimized during the period between the L/C issuance and payment.

Target Customers

1. Importer and exporter wish to promote the level of trade credit by making appointment on each other's business activities;

2. The imported commodity is within a seller's market and the exporter insists on settlement with L/Cs;

3. Both importer and exporter want to select trade finance out of the lack of liquidity.

Application Qualifications

1. The applicant shall be approved and registered in accordance with the law, and hold a business license that has passed the annual inspection or other valid certificates which fully prove its legal operation and scope of business;

2. The applicant shall have the qualification to engage in import and export trade.

Process

1. The importer submits the application for issuance of L/C, and United Finance will issue the L/C based on margin or credit line taken up after examination and approval;

2. The exporters prepares and ships the goods in accordance with the relevant L/C clauses after having been advised of the L/C;

3. The exporter presents the documents required by the L/C and the presenting bank mails the documents to United Finance to request payment or acceptance;

4. Upon receipt of the documents, United Finance will make payment or acceptance to the exporters after examination and approval;

5. United Finance makes the payment when the acceptance is due.

Advise of L/C

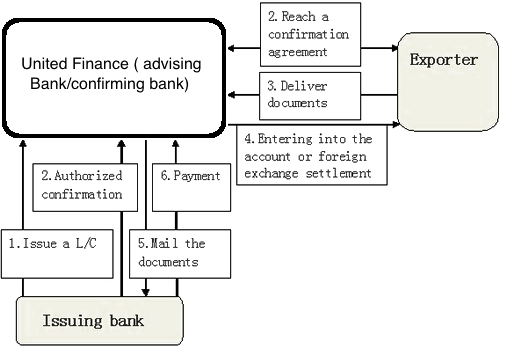

Confirmation of L/C

Introduction

Confirmation of L/C is the first payment obligation undertaken independently by United Finance for the beneficiary beyond the issuing bank.

Functions

Undertaking the credit risks of the issuing bank for the exporter so as to help exporter receive payments in advance upon complying presentation; it can be divided into two forms: open confirmation and silent confirmation.

Features

1. Reduction of risks and acceleration of the capital turnover. Confirmation of L/C can help exporters prevent the risks from the issuing bank, the country risk of issuing bank and the foreign exchange control risks.

2. Double guarantee. Apart from the conditional payment undertaking made by the issuing bank, the exporters can get additional conditional payment undertaking from United Finance, placing the exporters under double payment guarantee.

3. Payment collection guarantee. The exporters upon presentation that comply with the L/C’s requirements and approval of the Bank, can gain the non-recourse payments or payments promises.

Charges

2-6% of the confirmed amount, charged quarterly. The fee will rise subject to the degree of risks of the relevant countries or banks.

Target Customers

1. Exporters who wish to obtain payment confirmation from a bank other than the issuing bank;

2. Exporters who wish to obtain non-recourse funds after presentation of documents even if the issuing bank has a good credit standing.

3. Banking institutions without beneficial RMA agreements.

Application Qualifications

I. Basic requirements

- Legally approved and registered with annually checked business license and other documents effectively proving its legal status and business scope;

- Having the export and import operation qualifications;

- No blemished credit records in United Finance and/or other financial institutions.

II. The issuing bank is a financial institution granted with credit and having a good credit standing.

Process

1. United Finance provides confirmation upon the request of the issuing bank or exporter (beneficiary) when advising the L/C;

2. The exporter presents the complying documents to United Finance and United Finance makes non-recourse payments or irrevocable payments promises to the exporter after examination and approval;

3. United Finance mails the documents to the foreign issuing bank to claim confirmation of reimbursement and will confirm the payment after the foreign payment received.

4. United Finance will use its RMA with HSBC Bank UK to process the Confirmation of its L/C’s.

Tender Guarantee / Bid Bond

Introduction

A written document issued by United Finance at the request of the tenderee for bids of construction and procurement of project, committing that the tenderer will not withdraw or amend its bid during the validity period of the bid, and will sign the contract or submit performance guarantee within the preset time once winning the bid.

Functions

Solve the problem of mutual mistrust between the tenderee and tenderer with bank credit to realize smooth tender offer; replace cash margin by the tender guarantee/bid bond to reduce the financial pressure of the bidders.

Features

1. Solve the problem of mutual mistrust between both parties of a transaction. With good reputation, United Finance involves in the transaction and acts as a guarantor to promote smooth transaction by providing guarantee for the parties;

2. Reduce the financial pressure. As an alternative to cash margin, it can reduce tied up fund of the tenderer;

3. Indemnify the damaged party and penalize the defaulting party in case of breach of contract to avoid and reduce contract breaching activities, thus saving trouble and expenses arising from litigation or arbitration.

Charges

The tender guarantee/bid bond fees should be charged based on the principles and rates determined in accordance with relevant rules of United Finance; the fees for letter of guarantee in foreign currency shall be charged in the same way as for letter of guarantee in USD/EUR.

Target Customers

1. Contractors involved in contracted projects;

2. Suppliers involved in material procurement projects.

Application Qualifications

1. The applicant shall hold a business license of legal person that has passed the annual inspection or other valid certificates which fully prove its legal operation and scope of business;

2. The applicant shall have a loan card;

3. The applicant shall have an account opening permit and open a settlement account with United Finance;

4. The applicant shall have the qualification to engage in relevant business (such as qualification of contracting foreign projects, construction qualification of building enterprise, etc.);

5. The applicant shall have a credit line at United Finance, or pay full margin, or full guarantee acceptable to United Finance.

Process

I. Application for letter of guarantee

1. The applicant fills out an application form or a contract for issuance of a letter of guarantee;

2. The applicant pays margin or submits other counter guarantee;

3. The applicant submits primary documents related to the contract;

4. The applicant submits other documents necessary for issuance of a letter of guarantee as required by United Finance.

II. Examination and issuance of letter of guarantee

1. United Finance examines the customer qualification, underlying transaction and relevant documents;

2. United Finance confirms the customer's margin or credit line and other mortgages;

3. United Finance examines the written application and form of the letter of guarantee;

4. United Finance issues the letter of guarantee.

III. The Bond will be confirmed by HSBC Bank UK because of our signed RMA with them.

Kind Reminder

1. Amendment to letter of guarantee: The clauses of the letter of guarantee can be amended on request of the guaranteed party and the beneficiary, such as extension of the validity period.

2. Payment/compensation against letter of guarantee: In case the beneficiary claims compensation within the validity period of the guarantee, the applicant should be notified in time. The payment should be made after the guaranteeing bank examines the claim documents and confirms the documents are in compliance with the claim clauses of the guarantee.